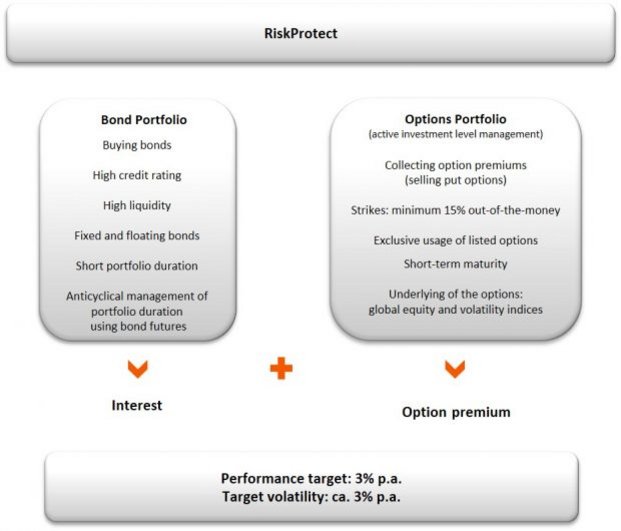

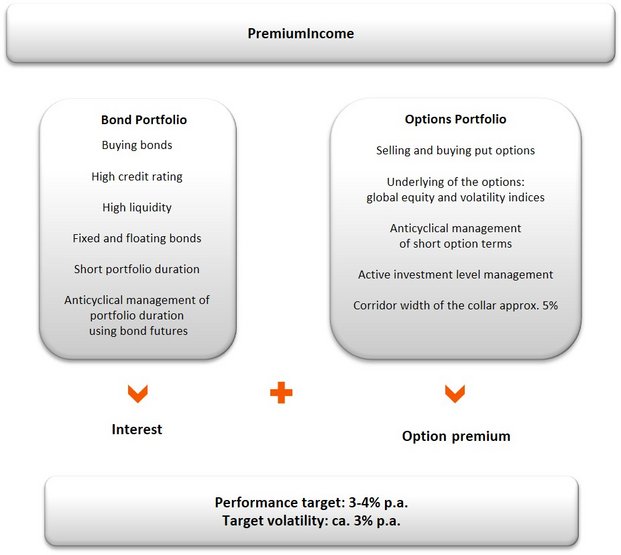

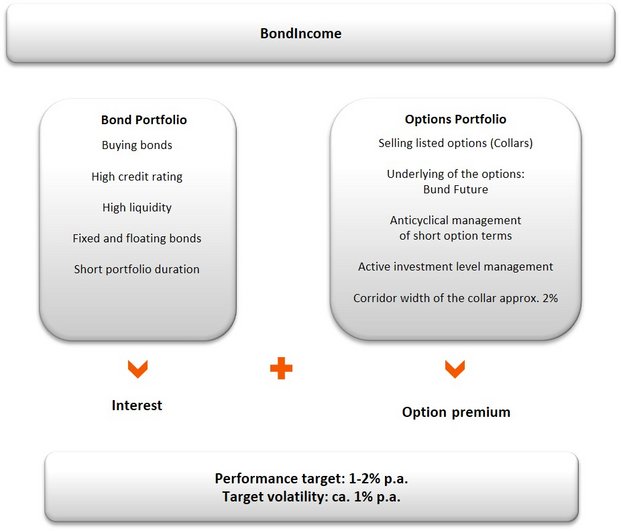

The strategy is designed to structure investments that generate consistent rates of return with low volatility. To achieve this, the portfolio managers pursues an investment strategy that combines the investment in a base portfolio of high-quality, fixed-income securities with the sale of put options on global equity and volatility indices. Using an active management approach makes it possible to consistently earn option premiums in addition to interest payments on bonds.

The aim of this strategy is to earn option premiums by writing short-term, exchange-listed put options on international equity and volatility indices. In order to minimise equity deltas, volatility, drawdowns and loss phases, these are written at least 15% out-of-the-money. In addition, we employ a very comprehensive and stringent risk management system as part of the active management of these options, including strict stop-risk rules and rules for early realisation of profits.